- US dollar rebounds ahead of Powell and other Fed speakers

- US futures also turn positive as Asian rally continues on China optimism

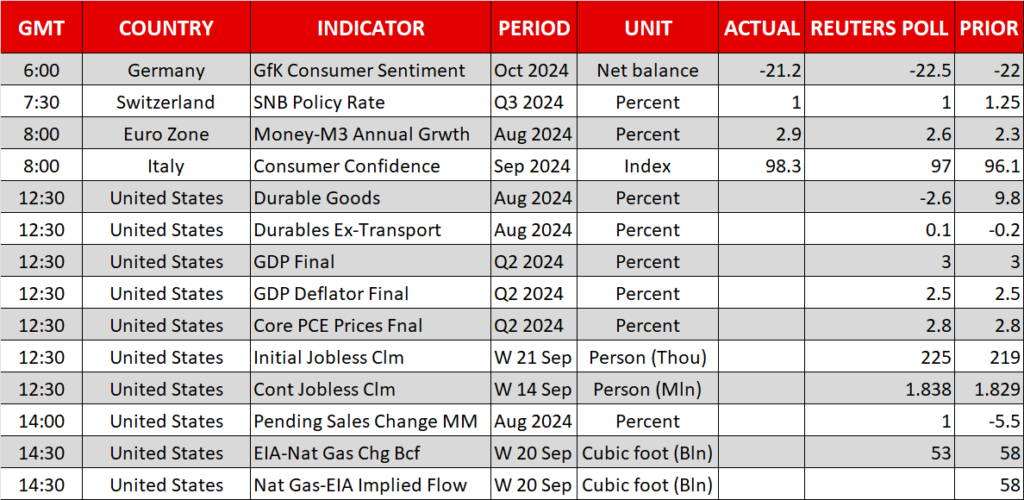

- SNB cuts rates by 25 bps as expected as ECB mulls October cut

Dovish Fed bets can’t keep the dollar down

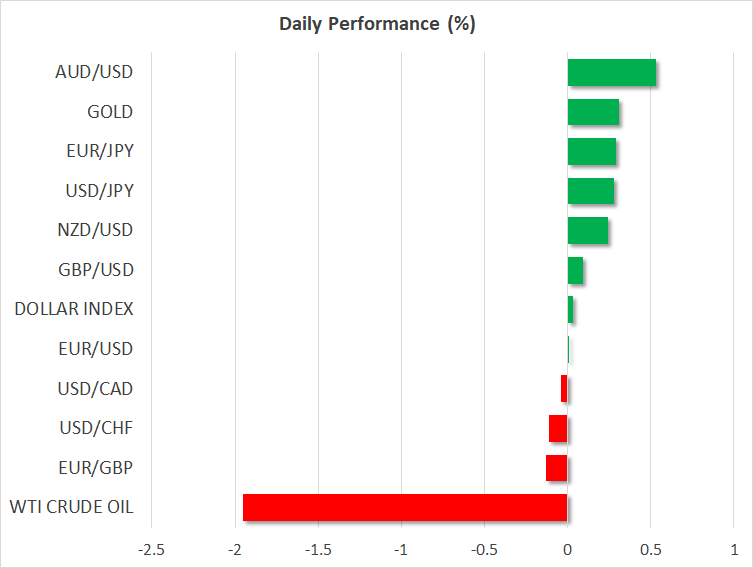

The US dollar is holding firm on Thursday after bouncing back strongly on Wednesday to recoup some of its post-Fed losses. The rebound comes despite the rhetoric from Fed officials remaining on the dovish side. Investors seem to be largely ignoring hints that further 50-basis-point cuts are unlikely unless either the labour market or inflation picture deteriorate rapidly.

The rebound comes despite the rhetoric from Fed officials remaining on the dovish side

The dovish expectations have been devastating for the dollar, even against currencies whose central banks are also cutting rates, while shares on Wall Street have been notching up fresh record highs. However, the bond market has been telling a different story as the 10-year US Treasury yield has been steadily crawling higher since the Fed’s decision last week.

Dollar finds support in uninverting yield curve

Although the two-year yield fell to a two-year low yesterday, the 10-year has recovered to just below 3.80%, helping the yield curve to uninvert. This is generally considered a positive development as it suggests the risk of a recession is declining, but it can also signal that investors see higher inflation down the line due to the Fed’s present monetary stance being too loose.

This divergence between short- and long-dated yields may be limiting the downside for the greenback

Hence, this divergence between short- and long-dated yields may be limiting the downside for the greenback after the Fed meeting, particularly against the surging Japanese yen. In a further boost for the dollar/yen, the minutes of the Bank of Japan’s July policy meeting published earlier today revealed that board members are divided on the speed of further rate hikes, lifting the pair above 145.00.

However, even if market expectations of aggressive cuts align more closely with the Fed’s projections over the coming weeks, it’s still likely that interest rates in the US will fall more quickly than in most other major economies and this is boosting currencies like the euro and pound, as well as the commodity dollars.

SNB cuts again, dollar eyes Powell, euro slips on ECB speculation

The dollar’s fightback is good news at least for the Swiss franc, whose recent strength has been causing headaches for the Swiss National Bank. As expected, the SNB cut its policy rate for the third straight meeting today by 25 bps to 1.00%. There was some speculation that the SNB might opt for a bigger 50-bps cut, but in the absence of any surprises both in the decision and in the statement, the franc edged slightly higher against the greenback and euro.

The focus now turns to Fed chief Jerome Powell who is due to deliver prepared remarks at the US Treasury Market Conference at 13:20 GMT. Any fresh clues on the pace of Fed rate cuts would likely spur a strong reaction in both the dollar and stocks.

Any fresh clues on the pace of Fed rate cuts would likely spur a strong reaction in both the dollar and stocks

The euro, meanwhile, gave up its earlier modest gains today to head back towards the $1.1120-$1.1130 region following a Reuters report that the doves at the European Central Bank will be pushing for a rate cut in October.

Stocks upbeat on China stimulus, oil struggles

In equity markets, Asian stocks led the positive mood after China unveiled plans to inject $142 billion into state banks to further increase lending. Strong earnings forecasts by US chipmakers Micron Technology further aided the rally by boosting tech stocks.

US futures are up today after a subdued session on Wall Street yesterday. As for commodities, gold seems undeterred by the dollar’s bounce back, but oil has been unable to capitalize on the risk-on tone amid expectations of higher supply from Saudi Arabia and Libya.

Source by: XM Global