- Mixed US PPI adds to uncertainty about Fed rate cuts

- Lingering inflation concerns and rising yields push the dollar higher

- Rate cuts in Europe pummel the euro and franc

- Pound slips too as UK GDP contracts for second straight month

Fed faces inflation dilemma

Uncertainty about the Fed’s policy direction increased this week following consumer and producer price inflation data that did little to reassure investors that inflation won’t pose a problem for policymakers in 2025. Yesterday’s PPI numbers added to the blurry picture set by Wednesday’s CPI report.

Producer prices in the United States increased by double the pace expected month-on-month in November, and whilst this was mainly driven by a jump in egg prices amid a breakout of avian flu, it still underlines the constant upside pressure on prices. Excluding food and energy, however, the monthly rise in PPI was in line with the forecasts.

Nevertheless, hopes of dissipating inflation are fading and although there’s been nothing in the data this week that could prevent the Fed from cutting rates at the December FOMC meeting, the outlook for next year isn’t as encouraging.

If the Fed does go ahead with the anticipated 25-bps reduction next week, investors see just two additional cuts for the whole of 2025.

Dollar lifted by higher yields

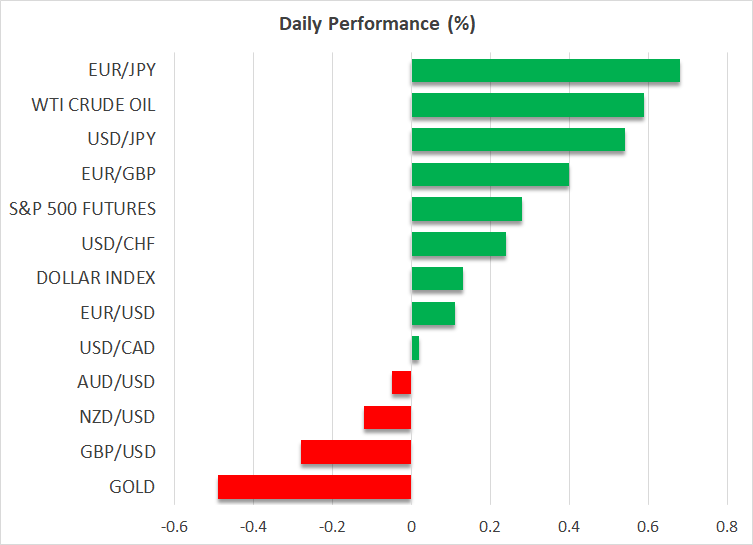

The pricing out of rate cuts has led to a steepening of the US yield curve, with the 10-year Treasury yield climbing back above 4.3% for the first time in more than two weeks, turbocharging the US dollar. Concerns about high government borrowing are exacerbating the rebound in yields.

The dollar is trading near three-week highs against a basket of currencies, capping gold’s advance, and is set for weekly gains of about 0.9%.

Wall Street fends off the bears, for now

Shares on Wall Street haven’t suffered a huge setback, however, as the data could still support the need for substantial Fed easing in the coming months, as highlighted by yesterday’s spike in the weekly jobless claims.

However, it’s mainly the rally in tech stocks that’s been propping up US stocks this week and if that sputters, Wall Street will be vulnerable to a sharp correction.

China stimulus pledges fail to impress

Stocks in Asia were mixed on Friday, while European indices edged modestly higher. Disappointment about China’s stimulus plans for the coming year continues to keep sentiment in check.

Senior Chinese officials concluded a meeting of the Central Economic Work Conference this week, and although Beijing is pledging to boost consumption and cut interest rates, the lack of details is leaving investors underwhelmed.

Pound joins the euro, franc and yen slide

In FX markets, the euro was licking its wounds after slipping to two-and-half-week lows yesterday following the ECB meeting. The ECB trimmed rates by 25 bps as expected and signalled that more are on the way. But President Christine Lagarde wasn’t outright dovish in her press conference, and this is providing some support to the single currency.

The same cannot be said about the SNB, which yesterday cut rates by a bigger-than-expected 50 bps. The Swiss franc is down about 1.8% this week versus the dollar.

The pound has also come under pressure amid another disappointing GDP reading out of the UK today. The British economy contracted for the second straight month in October, raising speculation that the Bank of England might sound a bit more dovish than expected at its meeting next week.

But it is the yen that’s Friday’s worst performer as the selloff continues on the back of the Bank of Japan’s hints of no policy action next week. An upbeat Tankan business survey was unable to stem the yen’s losses.