- Markets are preparing for an action-packed week

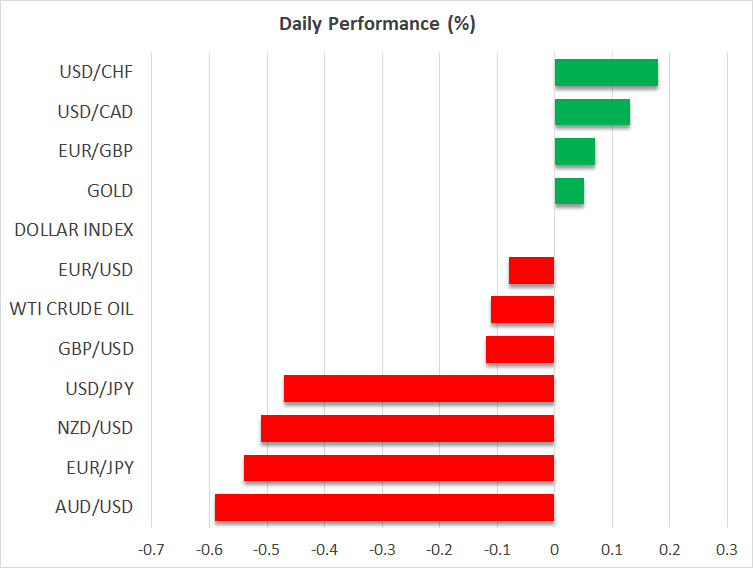

- The US dollar is on the front foot following the bank holiday

- Focus turns to the ISM manufacturing survey today

- Gold drops, oil recovers but outlook remains mixed

Focus on US data releases

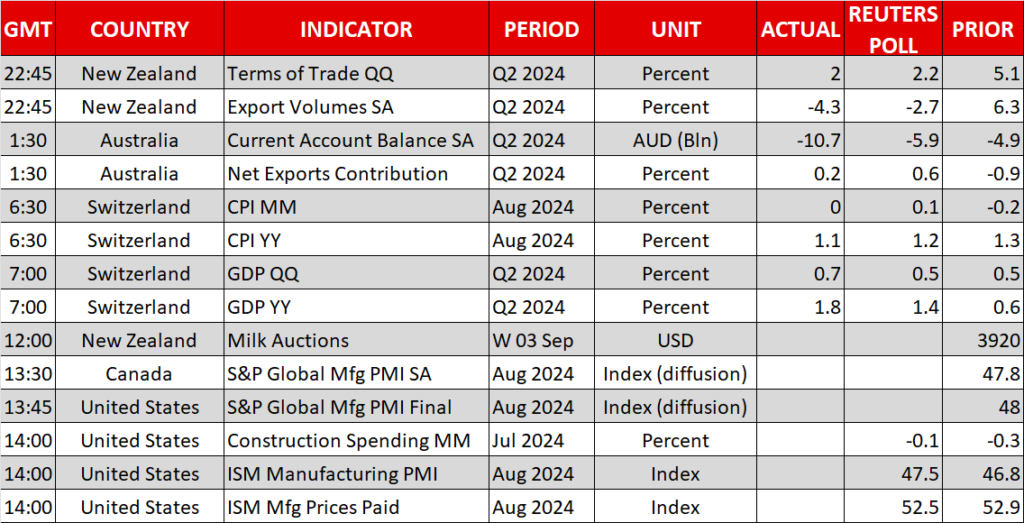

With US participants returning from the extended bank holiday weekend, the focus today will firmly be on the US data calendar. Fed Chairman Powell highlighted the importance of labour market data at his recent Jackson Hole speech, and hence today’s ISM manufacturing survey could set the tone for the rest of the week.

Fed Chairman Powell highlighted the importance of labour market data at Jackson Hole and hence today’s ISM manufacturing survey could set the tone for the rest of the week.

The employment subcomponent of the ISM manufacturing index dropped in August to the lowest level since July 2020, amidst the COVID pandemic. Another weak point today could increase the market’s concerns about another weak non-farm payrolls figure on Friday, well below the current economists’ forecast for a 160k increase. The extent of the possible labour market data disappointment this week could determine the size of the Fed rate cut to be announced on September 18. A very negative set of figures could support expectations for a 50bps rate move in two weeks’ time. However, the Fed probably wishes to avoid scaring the market with such an aggressive first step considering that the US data on the whole remains quite satisfactory.

A very negative set of figures could support expectations for a 50bps Fed rate move in two weeks’ time

Eurozone problems continue

The euro remains on the back foot following the recent local peak of $1.12 as problems in the eurozone multiply. European car manufacturers are rumoured to be preparing for a series of factory closures in Western Europe including Germany. Despite the recently announced tariffs on Chinese electrical vehicles (EV), European car manufacturers are severely behind the curve in terms of EV technology and thus face an uncertain future.

These closures might come at the worst time for the German government. Last weekend’s abysmal performance by the governing coalition at the regional election in two German states coupled with the strong showing from both right and far-right parties probably means that Chancellor Scholz has little chance of winning next year’s Federal election.

The ECB will almost certainly announce another 25bps rate cut next week, but such a move cannot solve most of the Eurozone’s current issues. Especially for Germany, the increased cost of energy due to the Ukraine-Russia conflict and the ongoing budgetary constraints have proven insurmountable obstacles for a consistent economic recovery.

Gold and oil switch direction

Following a rather quiet week, gold is finally on the move as it has dropped below the $2,500 level. With Israeli Prime Minister Netanyahu talking down expectations for a ceasefire, despite renewed pressure from outgoing US President Biden and numerous strikes taking place in Israel, gold’s latest move could be explained by profit-taking and repositioning for this week’s data prints and the key events during September.

On the flip side, oil prices are in the green at the time of writing. The bearish trend since the July 5 local peak of $84.24 remains in place as the OPEC+ alliance is preparing for a production increase. The market is expecting an addition of 180k barrels per day from October, but there are concerns of a larger jump in production quotas, partly on the back of Libya’s oil production issues.

There are concerns about a larger jump in production quotas, partly on the back of Libya’s oil production issues.

Such an announcement could tilt the demand-supply balance even more negatively, especially as the Chinese data prints continue to disappoint. Efforts by the Chinese administration to restart its economy have failed up to now, thus denting demand for oil and acting as a strong barrier to a sustained recovery in oil prices.

Source by: XM Global