- Strong US data dent chances of a 50bps Fed rate cut

- Plethora of Fed speakers on the wires today

- Dollar enjoys strong gains, stocks rally unexpectedly

- Oil pushes higher as gold’s retreat continues

US jobs report surprises to the upside, doves are displeased

Another exciting week commences as market participants are still digesting the unexpectedly strong US labour market data. The plethora of upside surprises has crushed the chances of another 50bps rate cut at the November 7 meeting, with even the doves acknowledging the fact that the US economy is confidently growing.

The plethora of upside surprises has crashed the chances of another 50bps rate cut at the November 7 meeting

We are likely to hear more about this issue this week, as more than 10 Fed members will be on wires, starting with Kashkari, Bostic, Musalem, and Bowman today. Apart from the doves, who will try to manage expectations after the strong US data, it will be interesting to see how the hawks handle the situation in terms of the need for another rate cut in November. Interestingly, the debate could become even more complicated if Thursday’s September CPI report produces another upside surprise.

Dollar enjoys a strong weekly performance

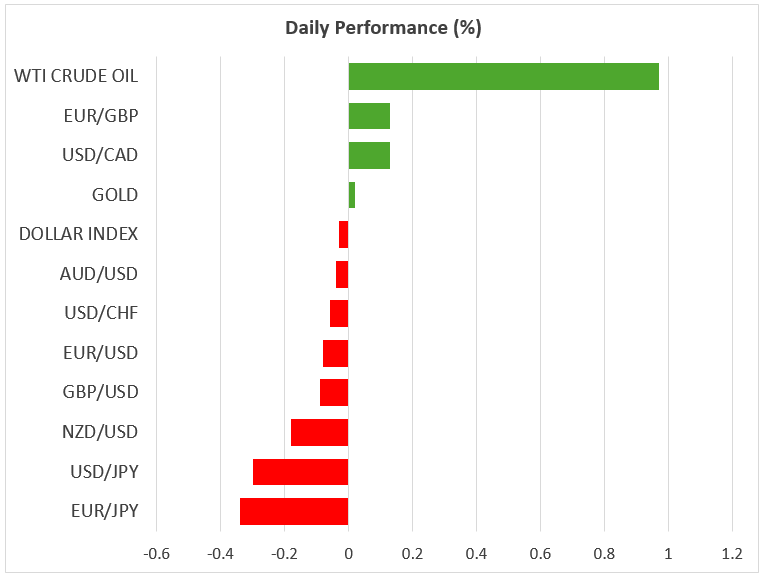

The US dollar was the main beneficiary of last Friday’s data, as the dollar index recorded its strongest weekly performance since September 23, 2022, led by the correction in euro/dollar, which at the time of writing is hovering below the key 1.1000 level, and with dollar/yen climbing abruptly above 148.00.

While the dollar’s reaction was largely expected, the equities’ move produced some question marks. Up to now, the positive market momentum was fueled by the expectations that the Fed will continue to ease its monetary policy stance. However, equities traded higher as if the market shifted gears and was more interested and content with the underlying strength of the US economy.

Equities traded higher as if the market had shifted gears and was more content with the underlying strength of the US economy.

This reaction was even more intriguing as the news flow from the Middle East remained negative. Disappointingly over the weekend, both Israel and Iran’s proxies continued their barrage of attacks, and there is no end in sight. Today marks the one-year anniversary of Hamas’ brutal attack inside Israel. With Israel still pondering its response to last week’s direct Iranian attack, which could even involve targeting Iran’s nuclear facilities, negotiations for a temporary ceasefire or a solution have broken down.

Pressure from President Biden for some sort of agreement will continue, and such an outcome might also boost Harris’s electoral chances. Indeed, we have entered that last stretch, as there are fewer than 30 days left before the election, which means the rhetoric from both sides is expected to become more aggressive.

Pressure from President Biden for some sort of agreement will continue, as such an outcome might also boost Harris’ electoral chances

Oil trades higher, gold is affected by the stronger dollar

Oil continues its journey higher, temporarily surpassing the $76 level, and thus trading around 13% higher from its early-September lows. This bullish move might have legs, as energy, oil and gas installations are high on the target list for both sides in the Middle East conflict.

On the flip side, the improved risk sentiment and the dollar’s gains have pushed gold below the $2,650 area. This is the fourth consecutive red daily session for gold, but a more protracted correction needs sustainably good US data and a barrage of positive news regarding the Israel-Iran conflict.

Source by: XM Global