- Eurozone PMIs dip into contraction zone, euro takes a dive

- Stocks mixed as weak PMIs offset optimism about China stimulus

- Dollar edges up as after Waller comments; Powell and PCE inflation eyed next

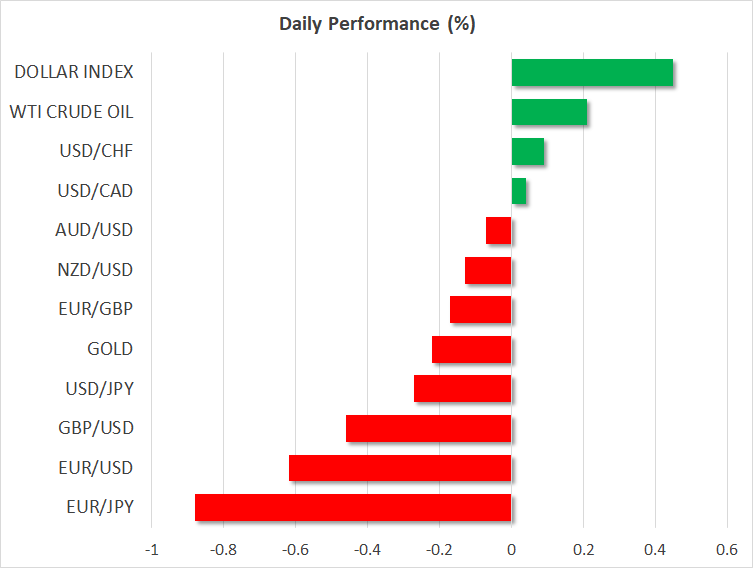

Euro tumbles as recession fears return

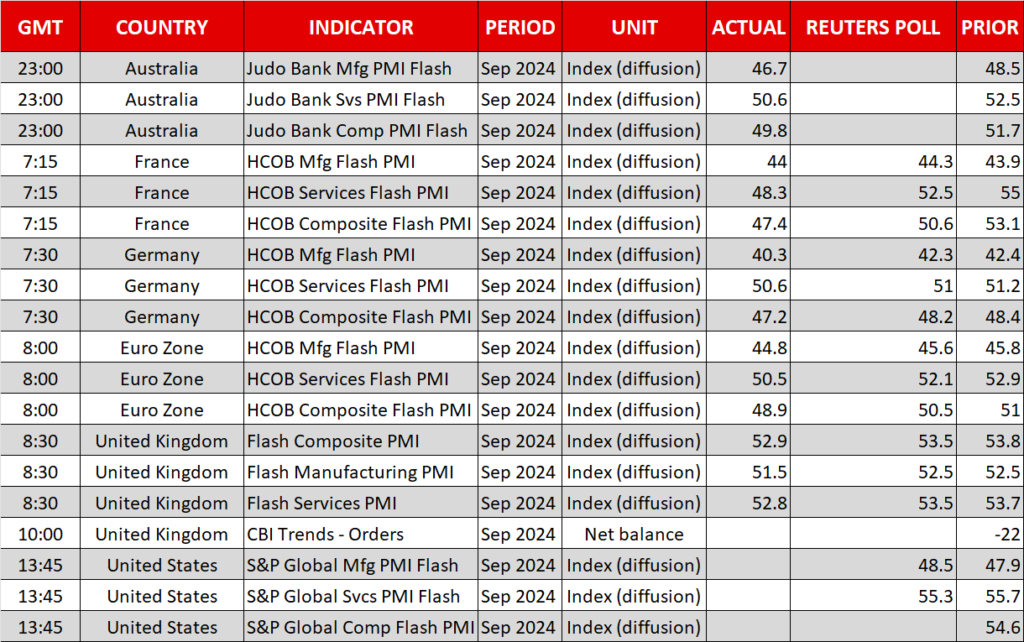

Eurozone business activity unexpectedly contracted in September according to the flash PMI estimates for September, sparking fresh concerns about the health of the economy. The S&P Global composite PMI fell to 48.9 in September from 51.0 in August, as German manufacturing output slumped to a one-year low while French services activity dropped back below 50.0.

The gloomy readings come after a short-lived Olympic Games-led bounce in August and after the European Central Bank guided investors towards December instead of October for the timing of the next rate cut.

The ECB’s cautious approach versus the Fed’s bold move to begin its easing cycle with an unusually large 50-basis-point cut had put a spring in the euro’s step, lifting it close to its August highs. But the PMI data might have just changed the narrative as investors responded by ratcheting up their bets of a 25-bps rate cut in October, pushing the odds to around 77% from below 70% prior to their release.

The PMI data might have just changed the narrative as investors responded by ratcheting up their bets of a 25-bps rate cut in October

The euro slipped below $1.11, while the pound also came under pressure. UK PMIs did not buck the European trend and fell in September but managed to hold comfortably above the 50 level.

Fedspeak takes centre stage

The US dollar started the week mostly on the front foot, although it was down against the yen and flat against the likes of the Aussie and loonie. Fed Governor Christopher Waller slightly dented expectations of a second 50-bps rate reduction this year in remarks on Friday by signalling he’s more likely to vote for a 25-bps cut at the remaining two meetings of the year.

However, he did soothe fears about a US recession by suggesting that the decision to lower rates by half a point was driven mainly by concerns of inflation undershooting the Fed’s target than by a worsening labour market.

Waller made specific reference to the decline in the 3-month annualized rate of the PCE price index, which puts extra focus on Friday’s data when the August numbers of the Fed’s favourite inflation gauge are due.

Waller made specific reference to the PCE price index, which puts extra focus on Friday’s data

Ahead of that, though, the spotlight will be on Chair Powell who is set to deliver a speech on Thursday and other Fed speakers will also be taking to the podium, including Goolsbee and Kashkari later today.

Stocks find support in rate cut and stimulus hopes

The flash PMIs for the US will be watched too and may generate some jitters in equity markets if they also miss expectations, amid doubts about the upcoming earnings season. FedEx, which reported its Q3 results last Thursday and is often seen as an economic bellwether, saw its share price plunge on Friday as it missed its earnings, in a potential sign of a slowing US economy.

This was likely a drag on Wall Street on Friday when the S&P 500 struggled to notch up a second consecutive closing all-time high.

The mood seems to be quickly turning around, with investors focusing on the prospect of faster rate cuts and more stimulus out of China

The poor Eurozone PMIs further weighed on sentiment today but the mood seems to be quickly turning around, with investors focusing on the prospect of faster rate cuts and more stimulus out of China. The People’s Bank of China caught markets by surprise on Monday, not only by cutting its 14-day reverse repo rate by 10 bps but also by scheduling a press conference for Tuesday on further economic support.

Gold, meanwhile, started the day by climbing to fresh record highs above $2,600/oz before succumbing to the stronger US dollar.

Source by: XM Global