- Fed lowers interest rates by 50bps

- New dot plot signals another 50bps cuts by December

- Wall Street closes in the red, futures point to higher open

- BoE and BoJ take the central bank torch

It has begun!

The Fed decided to kickstart this easing cycle with a bold 50bps rate cut, and to flag more reductions before the turn of the year. The new dot plot pointed to another 50bps worth of reductions by the end of 2024, which translates into two quarter-point cuts at each of the remaining decisions in November and December, or no action in November and another 50bps cut in December.

At the press conference following the decision, Powell said that the economy is strong overall, it is in a good place and that the decision was designed to keep it there. This means that he doesn’t see a strong likelihood of a downturn.

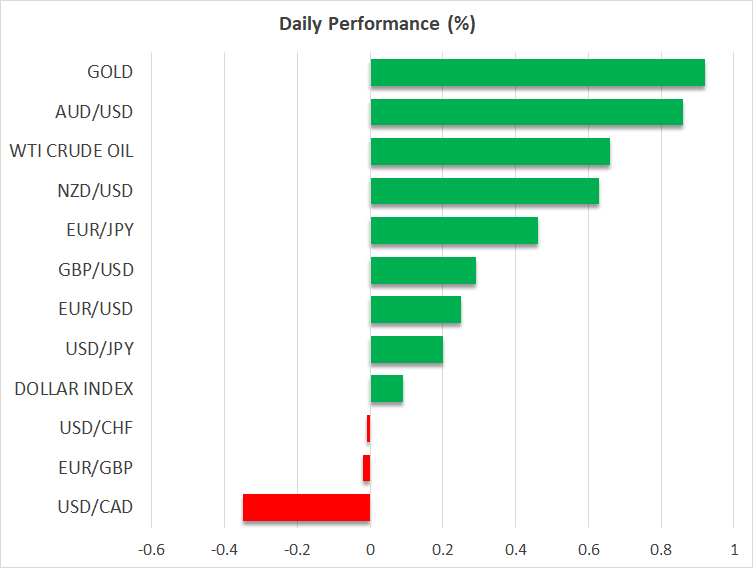

The dollar falls but recovers quickly

Although a bold double rate cut was largely anticipated by the markets, the dollar fell at the time of the decision, perhaps as most economists were leaning towards the smaller 25bps reduction. However, with Powell noting that there is no imminent risk of recession, the bulls jumped back into action, with the currency recovering a decent portion of its immediate losses.

Yet, the rebound was not strong enough to suggest a bullish reversal. Perhaps this was because, although the Fed’s actions were not as dovish as initially perceived by the markets, they were not much more hawkish either. Ahead of the decision, investors saw the 50bps cut as the main case, while penciling in another 65bps worth of reductions by the end of the year. After the decision, that number just went up to 70.

Moving ahead, for the dollar to stage a more meaningful comeback, incoming data may need to suggest that there is no need for the Fed to continue cutting aggressively. However, with other major central banks already seen proceeding with further easing at a smoother pace than the Fed, the greenback may be destined to remain on the back foot for now.

With other major central banks already seen proceeding with further easing at a smoother pace than the Fed, the greenback may be destined to remain on the back foot

Wall Street in the red, but futures point to solid recovery

Wall Street rallied initially, but pulled back thereafter to close in the red. That said, with Powell insisting that the US economy is in good shape and that they will do whatever is necessary to keep it that way, futures are pointing to a strong opening today. Expectations of steep rate cuts combined with solid economic performance may allow market participants to start cheering the prospect of lower borrowing costs and higher present values again.

Expectations of steep rate cuts combined with solid economic performance may allow market participants to start cheering again the prospect of lower borrowing costs and higher present values

Gold spiked to hit a new record high after the announcement of the double cut but was quick to pull back due to the dollar’s rebound. However, the bulls are back in charge today. With interest rates expected to continue falling, it may be a matter of time before we see the precious metal conquering uncharted territory again.

It may be a matter of time before we see the precious metal conquering uncharted territory again

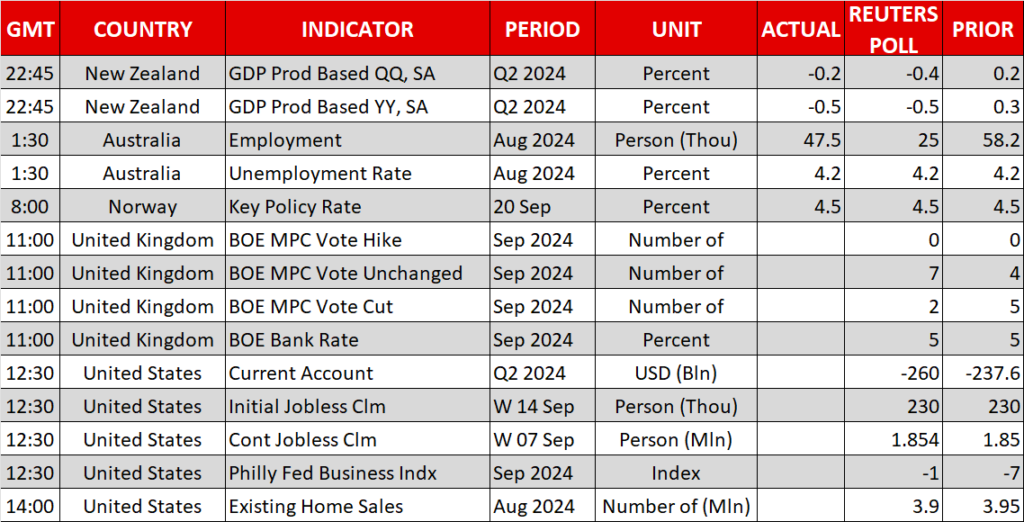

Both the BoE and the BoJ to remain sidelined

Today, the central bank torch will be passed to the Bank of England. This Bank is largely expected to stand pat, with investors assigning only a 20% chance of a 25bps cut at this gathering.

That said, they are fully penciling in 25bps cuts at each of the two remaining meetings for the year. Thus, it remains to be seen whether the stickiness in inflation will allow policymakers to clearly signal such a scenario.

During the Asian session Friday, it will be the Bank of Japan’s turn to decide on policy. No change is expected by this Bank either, but traders will be looking for hints and clues with regard to the next potential hike.

Source by: XM Global