- Dollar slides as data offer little respite to concerned investors

- NFP to accelerate somewhat, but PMI surveys pose downside risks

- S&P 500 and Dow Jones end in red ahead of the job numbers

- Gold rebounds, approaches record high; oil stabilizes

Data fail to alleviate investors’ worries

The dollar traded lower against all of its major counterparts on Thursday as the boost received by the better-than-expected initial jobless claims and the improving ISM non-manufacturing PMI faded.

The reason why traders were not enthusiastic about buying more dollars may have been the soft ADP report ahead of the aforementioned data, but also the decline in the employment sub-index of the ISM non-manufacturing PMI.

Worries about the state of the US labour market pushed higher the probability of a double 50bps rate cut by the Fed at its upcoming gathering, with that probability now standing at around 45%. The total number of basis points’ worth of expected reductions by the end of the year also increased to 112.

Worries about the state of the US labor market pushed higher the probability of a double 50bps rate cut by the Fed at its upcoming gathering

NFP the dollar’s biggest test

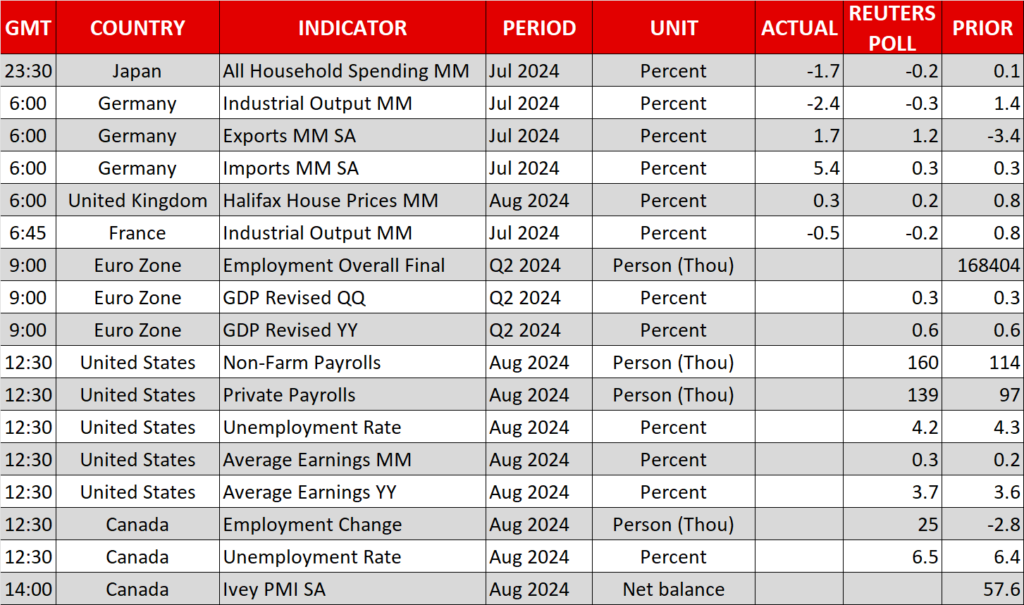

Investors are now probably biting their nails in anticipation of the official US employment report for August, with nonfarm payrolls expected to have accelerated to 164k from 114k, and the unemployment rate to have ticked down to 4.2% from 4.3%. Such an improvement may allow the dollar to strengthen, and Treasury yields to recover as traders could see a 25bps reduction at the upcoming Fed gathering as a more realistic scenario.

An improvement may allow the dollar to strengthen as traders could see a 25bps reduction at the upcoming Fed gathering as a more realistic scenario

That said, the ADP report revealed yesterday that the private sector gained 99k jobs in August, while the forecast of today’s report for private payrolls is at 139k. Combined with the relatively soft employment subindices of both the ISM manufacturing and non-manufacturing PMIs, this poses some downside risks to today’s data.

Risk appetite subdued ahead of jobs report

On Wall Street, the S&P 500 and the Dow Jones finished another day in the red, while the Nasdaq held 0.25% above its opening level. The fact that equities are sliding at times when Fed rate cut bets are piling up suggests that investors may be afraid that an economic downturn is coming.

In other words, bad data is actually bad for the stock market nowadays, as investors’ anxiety about the state of the world’s largest economy does not allow them to celebrate the prospect of lower borrowing costs. This means that a weaker-than-expected report may exert additional pressure on stocks and other risk-linked assets.

In other words, bad data are actually bad for the stock market nowadays

Gold rebounds, oil pauses free fall

The weakening dollar helped gold to rebound and get within breathing distance from its record high of $2,532, hit on August 20. Expectations of aggressive rate cuts by the Fed are benefiting the non-yielding metal and if today’s NFP report points to further cooling in the US labor market, the metal may climb into uncharted territory.

After Tuesday’s and Wednesday’s free fall, oil prices stabilized yesterday, perhaps aided by the dollar’s retreat, but also by news that the OPEC+ group was in discussions to delay a possible output increase due to a potential increase in Libya’s production following a deal to end the dispute that curtailed exports and production.

The oil-linked loonie held relatively strong, even as the BoC cut interest rates for a third consecutive time on Wednesday. That said, with investors anticipating a fourth reduction in October, today’s employment report may be a reason for volatility in the currency, especially against its US counterpart, as the Canadian jobs data comes out at the same time as the US numbers.

Source by: XM Global