- US presidential election in the spotlight

- Markets in anticipation mode as volatility is elevated

- Dollar, equities and gold remain under pressure

- Aussie fails to materially benefit from RBA’s hawkishness

The long wait is finally over

The countdown for the biggest event of 2024 is finally over as in a few hours around 80 million registered voters will cast their vote across the United States. Along with around 80 million that have already voted by absentee ballot and by mail, these voters will determine the next US president, the House of Representatives and 33 members of the Senate.

US voters will determine the next US president, the House of Representatives and 33 members of the Senate.

In most US states, polls will close at around 9pm ET (2am GMT). Alaska is the last to close its polls at 1am ET (6am GMT) while California has a deadline of 11pm ET (4am GMT). In the seven swing states, which will receive a good chunk of the market’s attention, voting concludes between 7-10pm ET (12-3am GMT).

The swift scenario is that the new president is crowned by Wednesday, with the market adjusting to the new environment and turning its focus to Thursday’s Fed meeting. On the flip side, a tight race, particularly in the swing states, could mean the market might have to wait until the weekend for the final result.

In the meantime, market participants continue to debate about the winner and the likely impact on key market assets. Additionally, countries across the globe are also preparing for the US election. For example, in China, the executive body of the Standing Committee of the National People’s Congress is meeting this week to debate the implementation of the fiscal measures announced in October. However, it is obvious that the US election will be the main topic of discussion, especially if Trumps wins and quickly adopts his favourite rhetoric about tariffs.

Markets in anticipation mode

The markets are in waiting mode, with the most notable movements recorded in US equities, gold and bitcoin. The S&P 500 index is experiencing its first correction since the early September weakness, while gold is hovering well below its all-time high. Interestingly, bitcoin is suffering the most, retreating from its recent high of $73,500, as anxiety about the US presidential election is peaking.

The markets are in waiting mode, with the most notable movements recorded in US equities, gold and bitcoin.

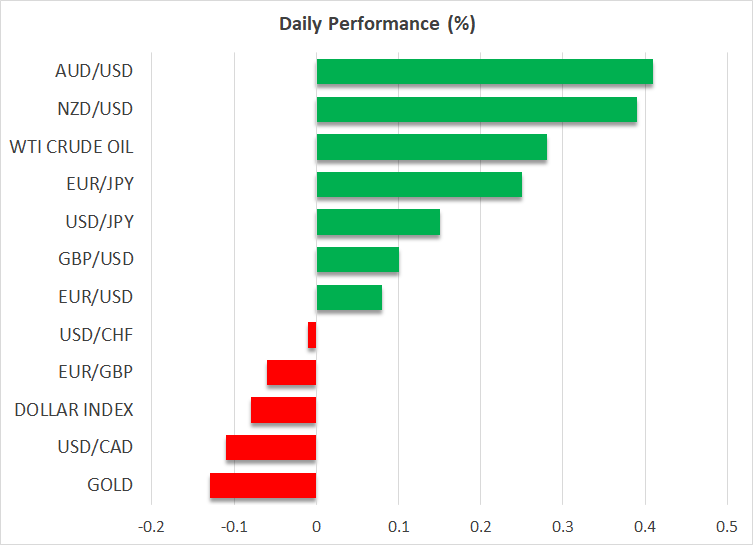

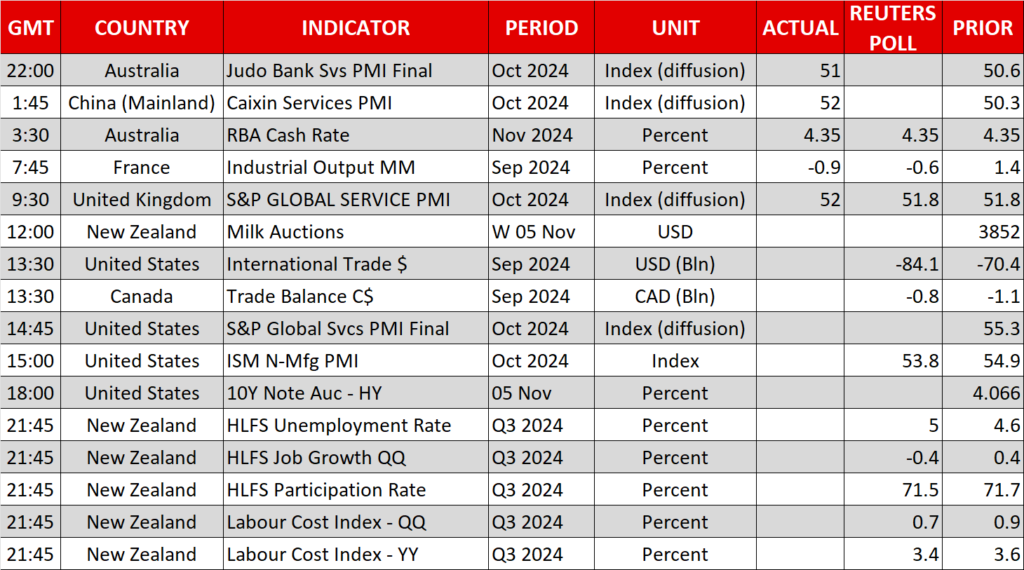

The US dollar is also on the back foot this week, underperforming against both the euro and the pound. But the biggest mover today is aussie/dollar. The RBA meeting did not produce a surprise with Governor Bullock et al maintaining their recent hawkish stance. Despite some downward revisions in the projections, the RBA does not expect inflation to sustainably return to the midpoint of its target until 2026.

The RBA meeting did not produce a surprise with Governor Bullock et al maintaining their recent hawkish stance.

While the first 25bps rate cut is priced in for May 2025, the Australian economy’s performance depends on China’s outlook, which could become even bleaker if Trump gets elected and repeats his 2016-2020 strategy.

German coalition could be under threat

While the market is fully focused on the US election, ignoring today’s calendar, which includes the key US ISM services survey, there is a crisis brewing in the German government. The compilation of the 2025 budget is creating new friction among the three coalition partners, which could even result in the dissolution of the current administration and potentially lead to a snap election in early 2025. The euro could be under pressure from such a development.

Source by: XM Global