- Stocks in the green again as investors await the Jackson Hole gathering

- Economists look for strong Fed easing in 2024 despite recession talk dissipating

- Dollar remains on the back foot against most currencies

- Aussie fails to benefit from hawkish minutes; loonie could suffer from weak CPI

Stocks still in the green

Stocks continue to enjoy green sessions as the market is counting down to Friday’s Jackson Hole speech by Fed Chairman Powell. Expectations for a dovish appearance are keeping equities happy, with the Nasdaq 100 index leading the rally once again and forgetting the recession talk that caused the recent market rout. Interestingly, the S&P 500 index has completed eight consecutive positive sessions. This is the first time this sequence has occurred since mid-November 2023 when a 30% rally commenced that ended with the all-time high recorded in mid-July.

The S&P 500 index has completed eight consecutive positive sessions, the first time this sequence has occurred since mid-November 2023

Despite the recovery of equities, both the market and economists maintain their dovish outlook for the Fed, partly due to expectations that inflation will maintain its recent disinflationary trend. A Reuters poll showed that 55% of analysts expect 75bps of easing this year with 34% looking for two 25bps rate cuts in 2024 and a sizeable 11% forecasting more than 100bps of easing in the next three Fed meetings.

A Reuters poll showed that 55% of analysts expect 75bps of easing this year

A hawkish show by Powell could upset the market

These forecasts are relatively aggressive considering the state of the US economy and potentially reveal analysts’ expectations that Chairman Powell will be relatively dovish at the Jackson Hole Symposium. This is probably the main market scenario currently priced in, which increases the possibility of an acute market reaction if Powell repeats his balanced view and fails to appear dovish.

Various Fed speakers have been on the wires lately, after a long absence, in a last-minute attempt to back Powell into a corner and thus force him to appear more dovish. We will see on Friday if their efforts have been fruitful as the Fed Chairman is obviously interested in having the largest possible support going into the September meeting and avoiding the issues faced by ECB President Lagarde after the June meeting.

Dollar fails to recover, on the backfoot against most currencies

The US dollar has been failing to recover part of the recently lost ground against most key currencies. The pound/dollar has swiftly returned to the 1.3000 area, close to the 2024 high of 1.3044, and euro/dollar is currently trading inside the key 1.1032-1.1095 region. Euro bulls have repeatedly failed to sustainably push above this area, but a potentially dovish show on Friday could help this pair climb higher.

Peripheral currencies continue to outperform the dollar with both the aussie and the kiwi gaining around 2.7% in August against their US counterpart. The former could remain bid as the minutes from the August 6 RBA meeting showed little appetite from the Reserve Bank board members for rate cuts at this stage, especially as they apparently considered raising rates two weeks ago.

The minutes from the August 6 RBA meeting showed little appetite from the Reserve Bank board members for rate cuts at this stage

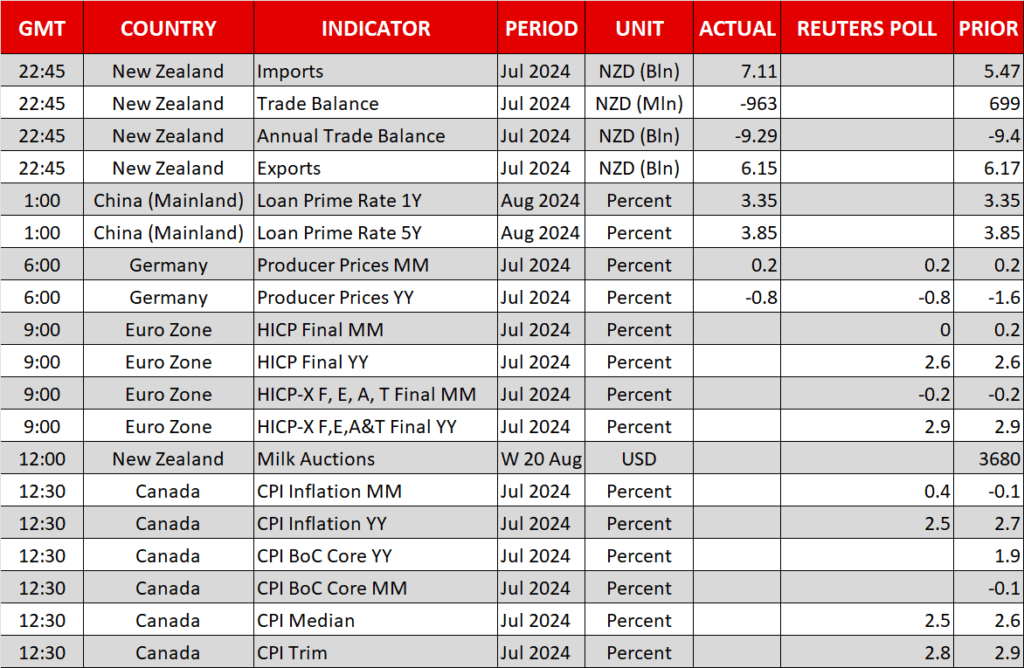

Similarly, the dollar/loonie is slightly in the red this month despite the 50bps of rate cuts already announced by the BoC and their willingness to do more if inflation eases. Today’s calendar includes the key CPI report for July.

Economists are looking for another weak inflation report with the headline CPI print dropping to 2.5% year-on-year, the lowest pace of price increases since April 2021, and the trim mean indicator falling to a three-year low. Such an outcome could justify the dovish BoC stance and hence cement another rate cut on September 4.

Source by: XM Global