- US dollar gains as data ease further recession concerns

- Aussie benefits the most, also helped by RBA’s Bullock

- Wall Street rebounds, oil and gold gain as well

Jobless claims drop the most in nearly a year

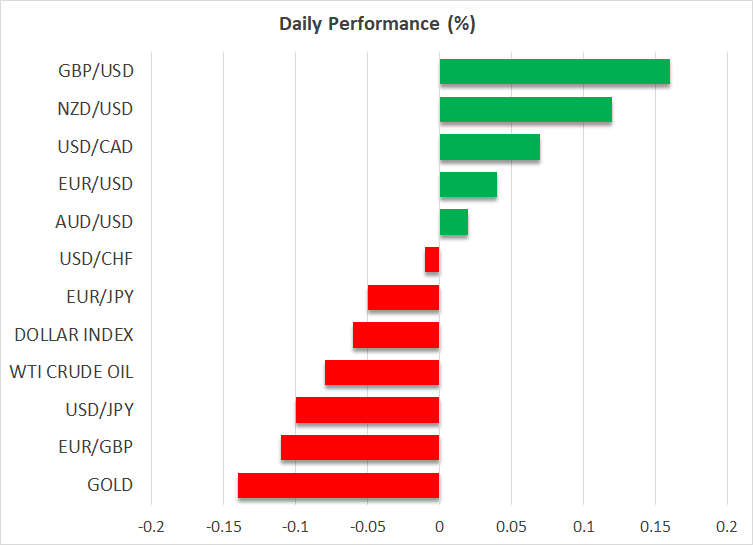

The US dollar ended Thursday mixed against the other major currencies, even though it received a boost from the better-than-expected initial jobless claims for last week. The greenback held onto gains against the safe-havens yen and franc, while it surrendered to the risk linked currencies, with aussie gaining the most.

Initial claims for unemployment benefits in the US dropped to 233k last week from 250k the week before, marking the largest drop in nearly a year and easing recession concerns even further.

Investors seem to be extremely sensitive to labor-related numbers and this is evident by the panic triggered by last week’s NFP report, as well as by the repricing just after the jobless claims yesterday. From penciling in around 125bps worth of rate reductions by the end of the year, market participants are now seeing around 100bps.

Investors seem to be extremely sensitive to labor-related numbers

Nonetheless, they are still assigning a decent 75% probability for a 50bps rate cut in September, which remains an overly dovish bet. This suggests that should data continue to point to an economy faring better than feared at the start of the week, Treasury yields may extend their rebound, thereby adding more fuel to the dollar’s engines.

RBA will not hesitate to raise rates if needed

The improvement in investor sentiment helped the risk-linked currencies to march higher, with the Australian dollar gaining the most ground. Apart from the broader appetite, the aussie received support from RBA Governor Bullock’s remarks as well.

Bullock said that she and her colleagues will not hesitate to raise interest rates further if needed to control inflation, adding to the hawkish picture painted by the outcome of the RBA’s decision on Tuesday. That said, despite the RBA’s readiness to take interest rates higher, traders are convinced that a 25bps reduction may be needed by December, assigning around a 45% chance for this happening in November.

Bullock said that she and her colleagues will not hesitate to raise interest rates further if needed to control inflation

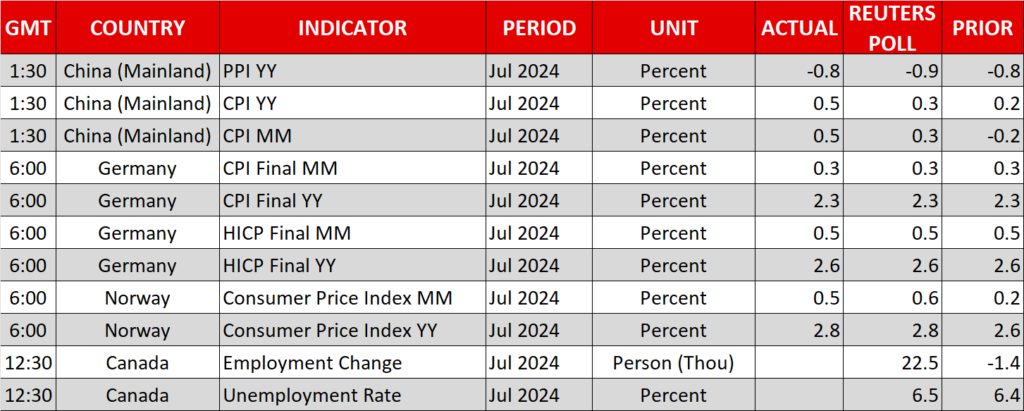

The New Zealand dollar also traded north even though the slide in the RBNZ’s inflation expectations pushed the probability for a 25bps rate cut next week to 80%. It seems that the improvement in risk appetite and China’s higher-than-expected inflation numbers were more important for traders. Signs of improving demand in the world’s second-largest economy are nothing but positive for the currencies of its main trading partners.

Stocks rebound, oil and gold gain as well

On Wall Street, all three of the main indices recorded strong gains following the better-than-expected US jobless claims, with the Nasdaq adding almost 3%. This confirms the narrative that good data is now good for stocks, even if this translates into fewer basis points worth of Fed rate cuts.

This confirms the narrative that good data are now good for stocks, even if this translated into fewer basis points worth of Fed rate cuts

Oil prices extended their recovery as the US data eased demand concerns but also as the escalation in the Middle East conflict intensified concerns regarding oil supply.

Gold rebounded as well after hitting support near the $2,380 zone. Although the precious metal did not behave as a safe haven when investors got nervous about the performance of the US economy, it seems that it is still acting as a shelter when geopolitical worries intensify.

Source by: XM Global