- BoJ holds rates steady but open to more rate hikes

- Yen benefits from upbeat policy statement

The Bank of Japan unanimously held rates unchanged at today’s meeting, fully confirming market expectations. However, the statement on monetary policy kept the door open to further tightening by stating that the BoJ expects a gradual increase in underlying inflation with the medium- and long-term inflation expectations also seen rising. The market continues to price in 8bps of additional tightening by year-end.

One of the main reasons for this positive inflation outlook is the brighter outlook penciled in for consumer spending, which, assisted by the stronger wage increases, is expected to rise moderately. Interestingly, the BoJ continues to highlight the heightened importance of FX moves at the current juncture, potentially revealing a degree of concern about the impact of the recent yen rally on imported inflation and export demand.

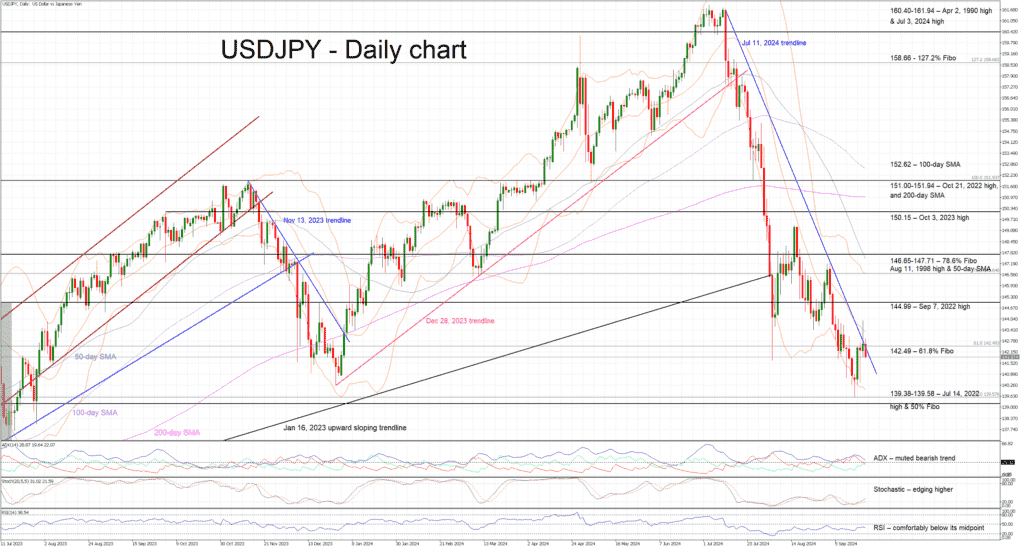

With the US dollar remaining on the back foot, the yen reacted positively to the BoJ policy statement. Dollar/yen is hovering around the 142.49 level with the market turning its focus to next week’s preliminary PMI prints and next Friday’s crucial Tokyo CPI report.

Source by: XM Global