- Fed announces a 50bps cut with more easing to come in 2024

- Dollar suffers a bit; US equities finish Wednesday’s session in the red

The Fed surprised the markets with an almost unanimous decision to cut rates by 50bps, despite still forecasting a relatively tight labour market. The accompanying statement and Chairman Powell’s press conference was relatively balanced and kept the door open to further easing down the line.

According to the dot plot, two 25bps rate cuts are the base case scenario until year-end, contrary to market expectations for another 70bps easing in 2024.

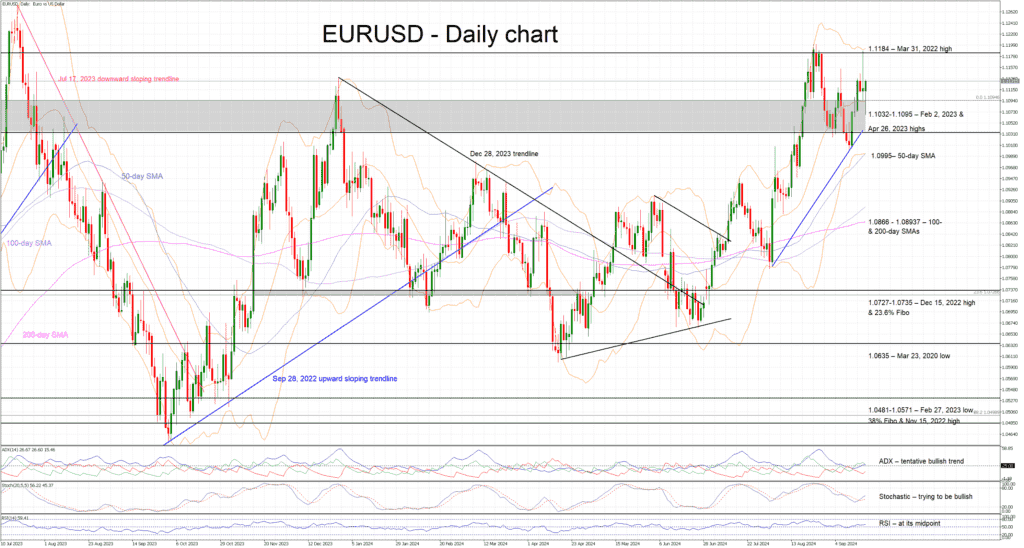

The US dollar reacted negatively to the rate cut announcement, but it has since managed to stage a small recovery against both the euro and pound. Similarly, US stock indices finished Wednesday’s session in the red, despite Powell being very cautious when commenting on the short-term outlook of the US economy. Oddly, contrary to expectations, US yields jumped higher, potentially because the Fed promised a more balanced pace of adjustment than priced in by the market.

The markets will continue to digest Wednesday’s developments, evaluate incoming information like today’s weekly claims and housing data, and prepare for a barrage of Fed speakers over the next few sessions.

Source by: XM Global