- Oil slides on strong dollar, Chinese demand concerns arise

- But Libya and Middle East supply disruptions keep a floor beneath prices

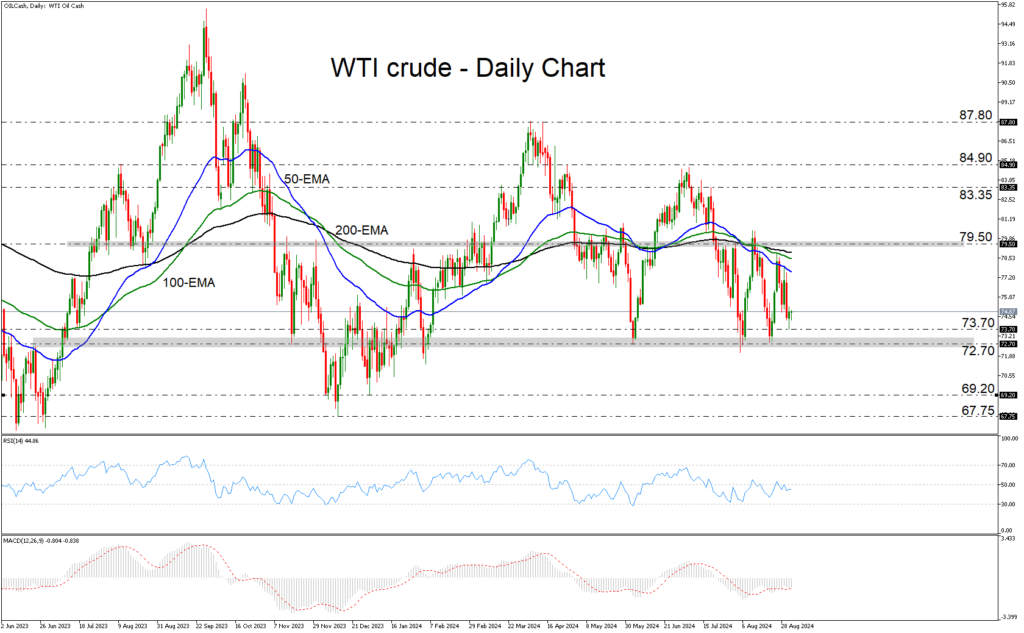

Oil prices finished last week in the red, tumbling on Friday perhaps due to the dollar’s recovery as well as worries regarding demand from China after OPEC cut its global oil demand growth forecast for 2024, citing lower intake expectations from the world’s second-largest economy.

The weaker-than-expected Chinese manufacturing PMI over the weekend likely exacerbated concerns about the Chinese economy’s performance, but crude prices managed to stabilize and rebound somewhat on Monday and early Tuesday.

The Libya and Middle East stories may be keeping a floor below prices, leaving the door open to a further recovery in the foreseeable future. In Libya, exports from the country’s major ports were halted, while production plummeted by more than half due to a political standoff. Continuing supply disruptions in the Middle East due to attacks on oil tankers are also a supportive variable for prices.

Source by: XM Global