- UK CPI remains at 2.2% y/y in August but core rate ticks up

- Services CPI also quickens slightly as BoE seen holding rates

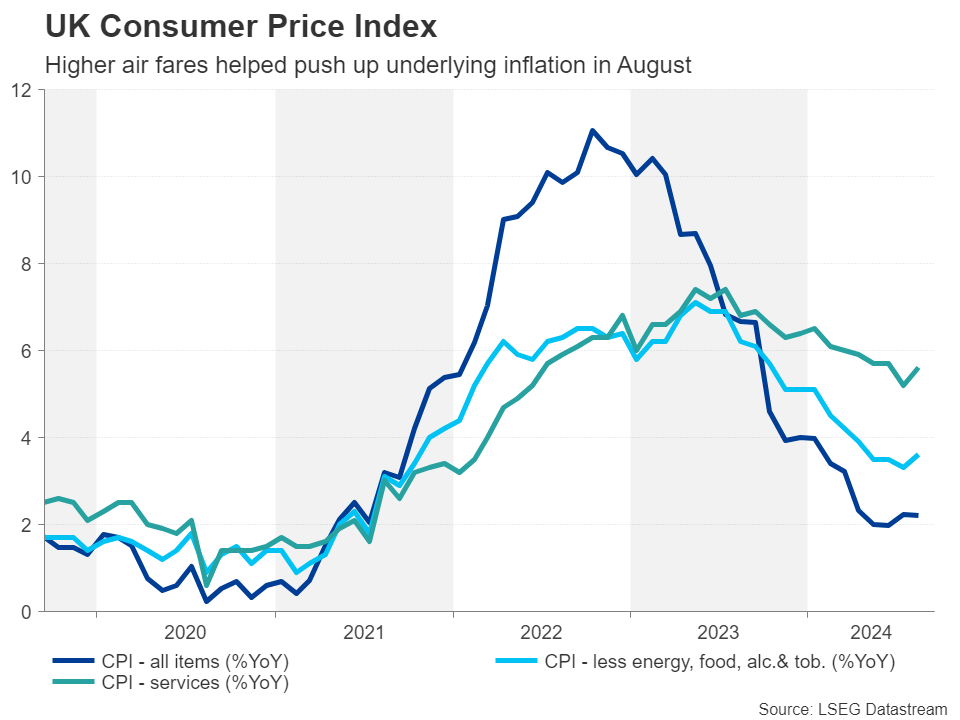

The UK’s inflation data for August was largely in line with expectations, changing little in terms of rate cut expectations for tomorrow when the Bank of England is due to announce its latest policy decision. The headline CPI rate held steady at 2.2% y/y as expected, but core CPI increased from 3.3% to 3.6% y/y, beating forecasts of 3.5%. Services inflation also accelerated, rising from 5.2% to 5.6%, although the month-on-month rate slowed compared to the prior month.

The pound, which started the day somewhat on the backfoot against its major peers, edged higher after the data, as investors see a slightly lesser chance of the BoE cutting rates on Thursday. It was last trading around 1.3190 against the US dollar.

Still, after the flat GDP growth in both June and July and the fact that the upward pressure in August CPI mainly came from higher air fares, which tend to be volatile, the BoE is unlikely to sound more worried tomorrow. Hence, there may still be some downside risks for sterling from the meeting, if not from a rate cut than from hints of future easing.

Source by: XM Global