- AUDUSD increases 7% in August

- 20- and 50-day SMAs post bullish cross

- Stochastic in overbought region

- RSI still beneath 70 area

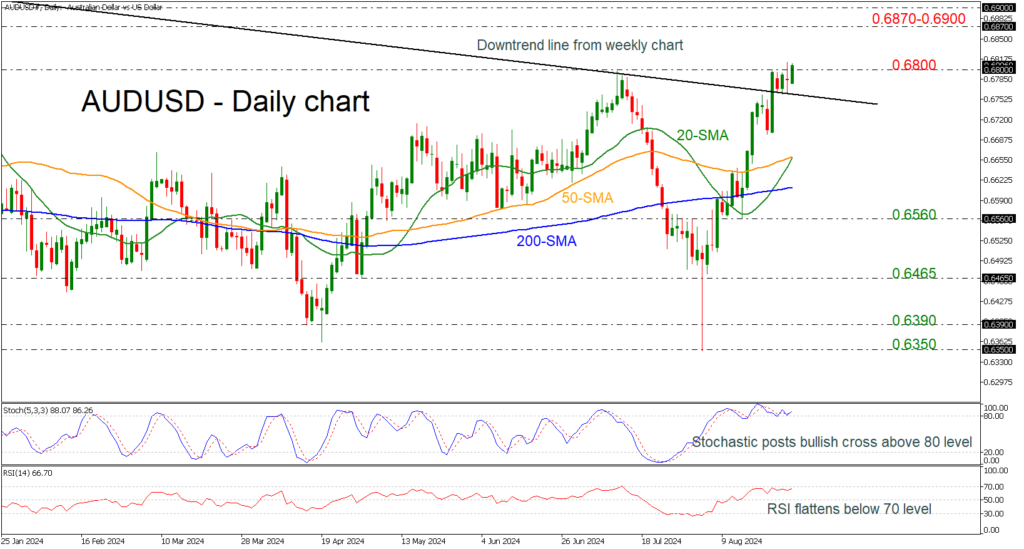

AUDUSD hit a new eight-month high above the 0.6800 round number, breaking the long-term descending trend line to the upside. Following the bearish spike on August 5, the pair gained over 7%.

Technically, the 20- and 50-day simple moving averages (SMAs) are ready for a bullish crossover. The stochastic oscillator is pointing north above the 80 level, whereas the RSI is moving horizontally near the 70 area.

More advances may drive the market towards the next resistance of 0.6870, which is taken from the high on December 28. If the bulls continue to buy the pair, then the market may challenge the 0.6900 round number, achieved in July 2023.

In the negative scenario, a drop beneath the diagonal line could indicate a retreat until the 20- and 50-day SMAs at 0.6660. Even lower, the 200-day SMA at 0.6610 could be a real struggle for traders.

Summarizing, AUDUSD has shown a significant improvement, but only a successful rally above 0.6800 could confirm a bullish retracement.

Source by: XM Global