- EURCHF edges higher, tests a strong resistance level

- The recent downward trend is still in place

- Momentum indicators confirm the prevailing bearish pressure

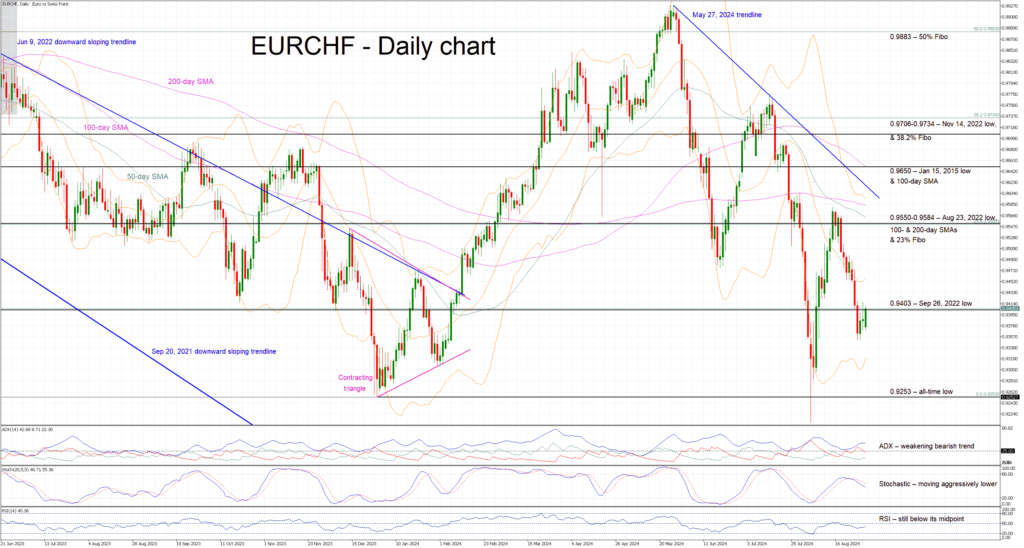

EURCHF is trading higher today, testing the resistance set by the September 26, 2022 low at 0.9403 as the bulls are trying to counter the continued downward pressure that resulted in the all-time low of 0.9209 recorded on August 5. Market participants are potentially preparing for Tuesday’s inflation report from Switzerland, which could open the door to a 50bps rate cut at the September 26 SNB meeting.

In the meantime, the momentum indicators are mostly bearish. In more detail, the RSI is trading below its midpoint and thus confirming the recent strong bearish pressure. More importantly, the stochastic oscillator has broken below its moving average, and it is edging aggressively lower. Should this move pick up speed, it could be seen as a very strong bearish signal. However, the Average Directional Movement Index (ADX) is trading sideways and thus pointing for the weakening bearish trend in EURCHF.

Should the bulls remain confident and manage to push EURCHF above the 0.9403 level, they could stage a rally towards the busier 0.9550-0.9584 area. This region is populated by the August 23, 2022 low, the 23.6% Fibonacci retracement of the June 9, 2022 – December 29, 2023 downtrend, and the 100- and 200-day simple moving averages (SMAs). If successful, the bulls could then have the chance to gradually retest the January 15, 2015 low at 0.9650.

On the flip side, the bears are probably trying to maintain their recent significant gains. They could try to keep EURCHF below the 0.9403 level and then gradually push EURCHF towards December 29, 2023, low at 0.9253, with the all-time low of 0.9209 being just a tad lower.

To sum up, EURCHF bulls are trying to regain market control and limit their recent losses with the next key leg in EURCHF most likely dependent on Tuesday’s Swiss inflation report.

Source by: XM Global