- EURCHF tumbles to a fresh 1-month bottom

- But the price finds its feet at the 61.8% Fibo

- Momentum indicators are heavily skewed to the downside

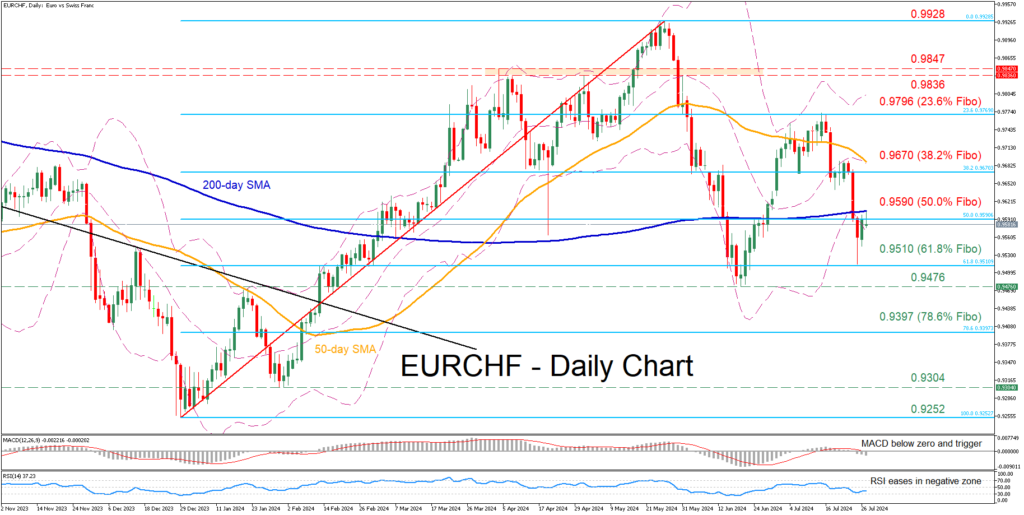

EURCHF has been undergoing a strong pullback following its rejection around 0.9796, which is the 23.6% Fibonacci retracement of the 0.9252-0.9928 upleg. Although the pair managed to pause its retreat at the 61.8% Fibo of 0.9510, its rebound is being held down by the 200-day simple moving average (SMA).

Should the negative bias persist, the bears could attempt to send the price below the 61.8% Fibo of 0.9510 and attack the five-month bottom of 0.9476. A break below the latter could pave the way for the 78.6% Fibo of 0.9397. Failing to halt there, the pair may challenge the January-February support of 0.9304.

On the flipside, if the price breaks above the 50.0% Fibo of 0.9590 and 200-day SMA, the 38.2% Fibo of 0.9670 could act as the next line of defence. Further advances could then cease at the July rejection region of 0.9796, which is also the 23.6% Fibo. Even higher, the pair might meet resistance at the 0.9836-0.9847 range, defined by the May resistance zone and the April peak.

Overall, EURCHF has been attempting a rebound from its fresh one-month low, but the 200-day SMA has been acting as a strong ceiling. Therefore, a decisive break above that crucial hurdle is needed for the bulls to regain confidence for a broader recovery.

Source by: XM Global