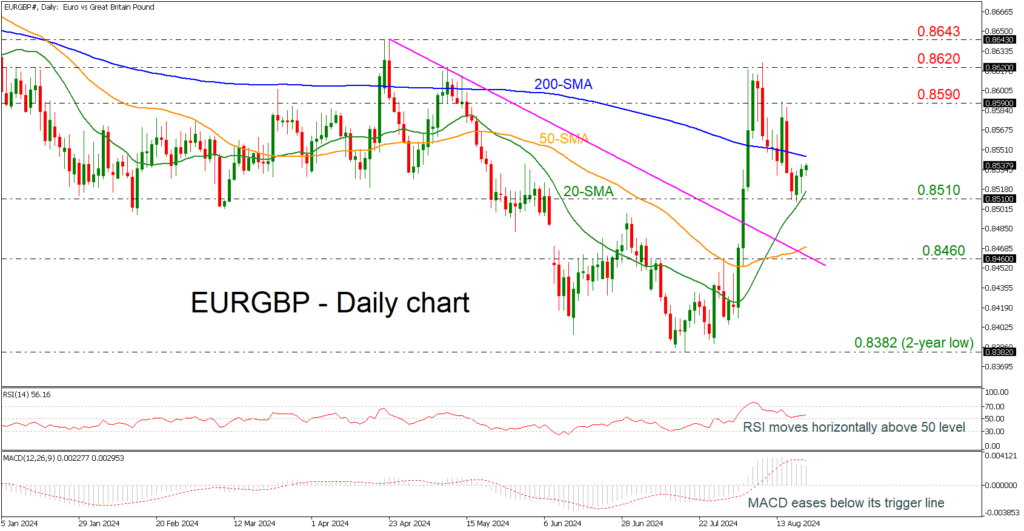

- EURGBP rebounds off 0.8510

- Prices remain above downtrend line

- RSI and MACD above their mid-levels

EURGBP looks to be creating a floor around the 0.8510 support level, with strong obstacles coming from the 200-day simple moving average (SMA) near 0.8545. The pair is developing above the downtrend line but still needs some boost to confirm the bullish structure in the short-term view. The RSI is moving horizontally slightly above the neutral threshold of 50; however, the MACD is losing some steam beneath its trigger line.

Traders, however, would be more eager to engage in buying activities if the price managed to surpass the 200-day SMA at 0.8545. If this is successfully breached, then the rally may next rest somewhere between 0.8590 and 0.8620.

On the flip side, the selling pressure could accelerate again if the market deteriorates below the 0.8510 former strong support area. Such a move could next bring the 50-day SMA at 0.8470 under the spotlight, which, if violated, could trigger more losses, probably below the 0.8460 barricade. In brief, EURCHF is expected to show improvement if the price overcomes the 0.8620 resistance zone.

Source by: XM Global