- US 500 bearish correction in short-term is not enough for retracement

- Momentum oscillators turn up

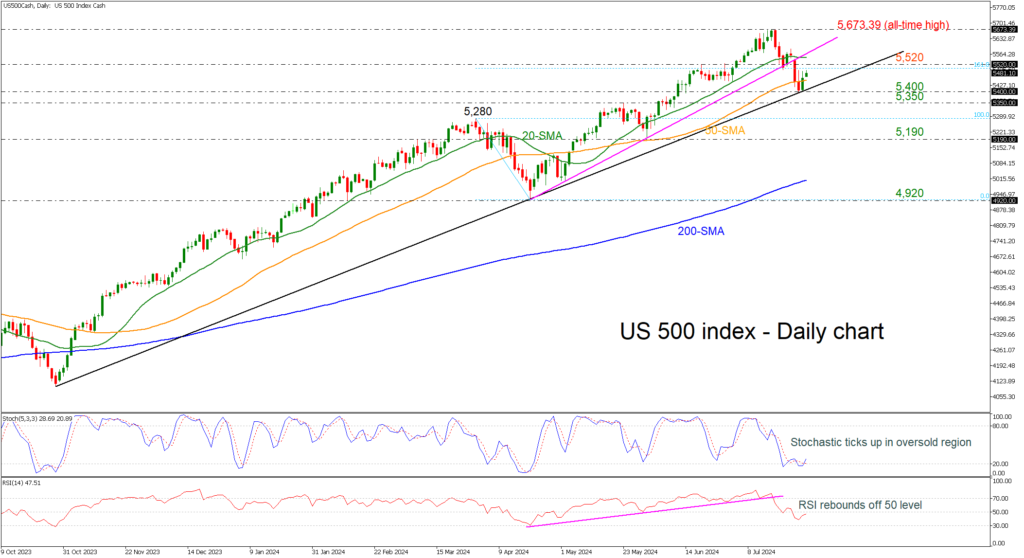

The US 500 (cash) index rebounded significantly off the long-term ascending trend line and surpassed beyond the 50-day simple moving average (SMA).

The bearish correction in the short-term view may came to an end as the technical oscillators are also sloping up. The stochastic recorded a bullish crossover within its %K and %D lines, while the RSI is heading north marginally beneath the 50 level.

Immediate resistance could come from the 5,520 barrier before resting near the all-time high at 5,673.39 again.

On the other hand, a plunge below the uptrend line could send the index towards the support region of 5,350-5,400. More downside correction could lead the market until the 5,190 barricade.

Summarizing, the US 500 index penetrated the short-term rising trend line to the downside but the broader outlook is still strongly positive.

Source by: XM Global