- PCE inflation holds steady, 50bps cut less likely

- Euro slips as Eurozone inflation drops to lowest in three years

- Wall Street gains on soft-landing hopes

Traders scale back Fed rate cut bets as NFP week begins

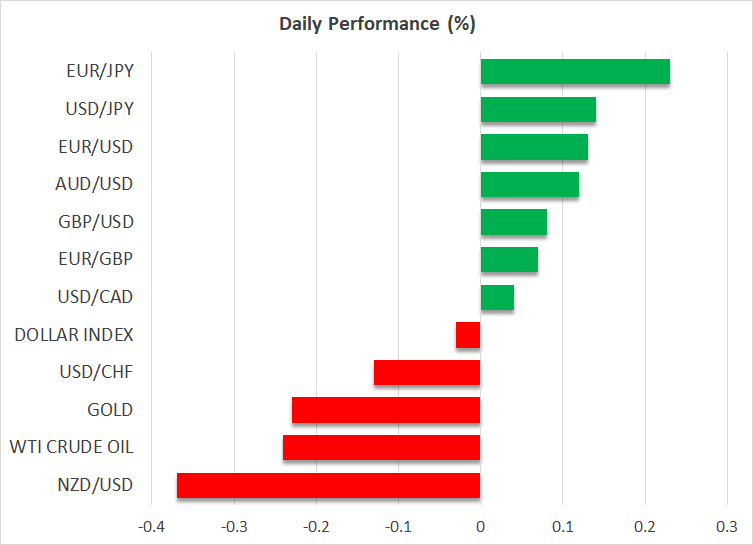

The US dollar finished last week on a strong footing, gaining against all its major counterparts on Friday, with market participants somewhat scaling back their Fed rate cut bets.

The total number of basis points worth of reductions by the end of the year remained at around 100, but the probability of a double 50bps cut at the upcoming Fed gathering was reduced to 30% from 35%.

Friday’s data revealed that both the headline and core PCE rates held steady, confounding expectations of upticks and yet, the market was not tempted to increase speculation for a 50bps rate cut.

On the contrary, coming on top of the upward revision in GDP for Q2, the fact that the Fed’s favourite inflation gauges did not reveal further slowdown was probably enough for investors to lean even more towards the case of a quarter-point reduction on September 18.

The fact that the Fed’s favourite inflation gauges did not reveal further slowdown was probably enough for investors to lean even more towards the case of a quarter-point reduction

Bearing in mind that Fed Chair Powell noted recently at Jackson Hole that he and his colleagues will not tolerate further softening in the labour market, the spotlight this week is likely to fall on the nonfarm payrolls for August.

Expectations are for the labour market to have gained more jobs than it did in July and for the unemployment rate to have ticked down to 4.2% from 4.3%. This may further convince investors that a bold 50bps is not imminent, thereby allowing the US dollar to extend its recovery.

The ISM PMIs on Tuesday and Thursday could also play an important role in the dollar’s fate, as improvement in business activity will add credence to the notion that the US economy is not heading for a recession.

Slowdown in Eurozone inflation cements September cut

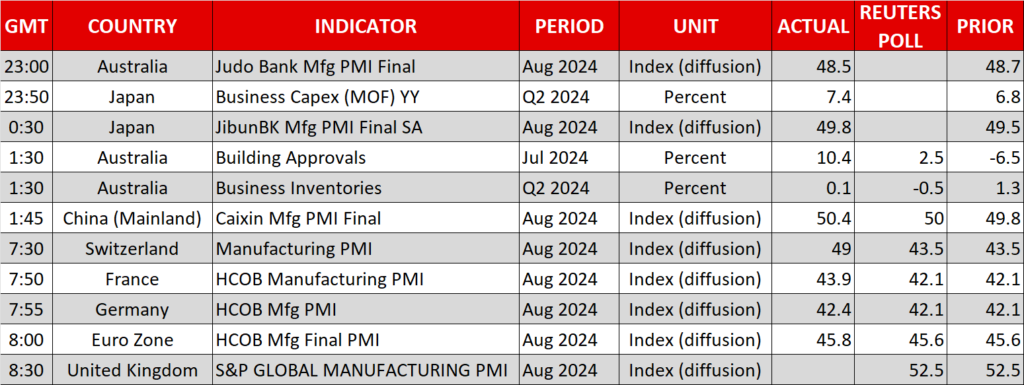

The euro fell to a two-week low against its US counterpart after data showed that, in August, inflation in the Eurozone slowed from 2.6% y/y to 2.2%, the lowest rate since July 2021.

The core CPI rate ticked down to 2.8% y/y from 2.9%, which suggests that the fall in headline inflation was mostly driven by lower energy prices, meaning that prices could reverse higher in the not-too-distant future if oil rebounds as well.

Yet, the drop in the headline CPI rate cemented the deal for a quarter-point cut by the ECB at the September 12 meeting, with money markets pointing to another two by January.

Although the implied rate path for the ECB is less dovish than the Fed’s, policy decisions further down the road may be more complicated and uncertain for the ECB, as officials seem to be increasingly at odds with regard to the growth outlook, according to sources.

Policy decisions further down the road may be more complicated and uncertain for the ECB

Wall Street up as soft-landing chances increase

Wall Street enjoyed a second consecutive day of gains on Friday, notwithstanding the slight reduction in investors’ expectations for a 50bps cut by the Fed at its upcoming meeting. Perhaps the upward revision in GDP allowed market participants to cheer the prospect of a soft landing.

It seems that investors are willing to celebrate anything pointing to improving the performance of the US economy, even when they are raising their implied rate path. This suggests that if Friday’s jobs data comes in better than expected and translates into even fewer expected rate cuts, equities could still march north, especially if the ISM PMI reveal further improvement in business activity.

It seems that investors are willing to celebrate anything pointing to an improvement in the performance of the US economy, even when they are raising their implied rate path

Wall Street will stay closed today in celebration of Labor Day.

Source by: XM Global