- Dollar weakness dominates the FX space

- Today’s Fed minutes could halt the euro/dollar rally

- Markets are gearing up to Powell’s Jackson Hole speech

- Oil prices remain under pressure

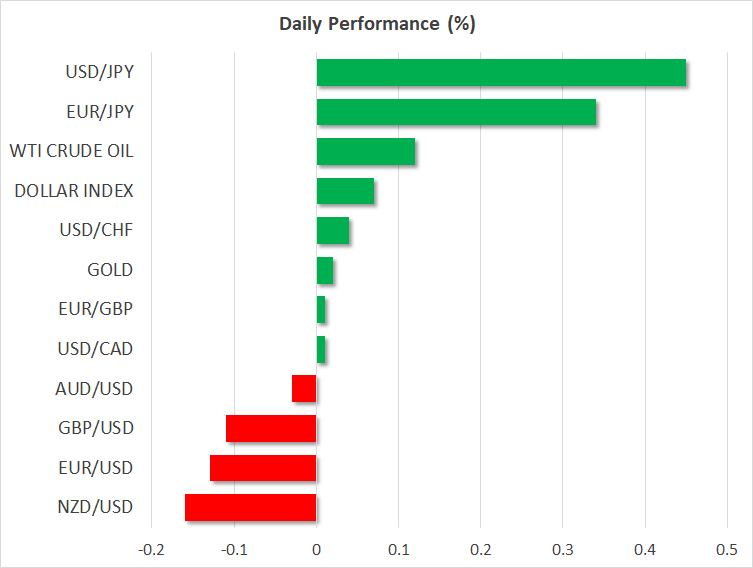

Dollar underperformance continues

The euro continues to take advantage of the US dollar’s weakness by trading to the highest level since December 2023. This pair has managed to quickly climb above the critical 1.1032-1.1095 area, which has acted as strong resistance recently, with the next plausible target being at 1.1184.

The euro continues to take advantage of the US dollar’s weakness by trading to the highest level since December 2023

Positioning is playing a key role in the current euro/dollar rally, which sounds sensible considering the continued economic divergence between the two regions. Tomorrow’s PMI surveys are expected to confirm this deviation, potentially denting the euro’s strength.

Similarly, the July 31 Fed minutes, scheduled to be released later today, could also stop the euro/dollar from recording another green candle. Usually, Fed minutes are not market-moving, but this could change this time around if Fed members had a low appetite for rate cuts at the last meeting, confirming Chairman Powell’s balanced message on July 31.

This dollar underperformance is dominating the FX space with pound/dollar climbing to a one-year high and dollar/yen retesting the support set by the 144.99 level. According to the latest polls, the majority of economists expect further rate hikes by the BoJ with the interest rate climbing to 0.5% by year-end, in stark contrast to a recent Reuters poll pointing to at least three rate cuts in the works for the Fed in 2024.

All eyes are on Jackson Hole

However, the key event of the week remains the Jackson Hole Symposium. The market is gearing up for Friday’s speech by Chairman Powell with Fed board member Bowman, a known hawk and 2024 voter, pouring cold water on expectations for a very dovish speech by Powell.

Fed board member Bowman poured cold water on expectations for Powell’s very dovish speech.

The market is facing a plethora of scenarios from Powell announcing the September rate cut, and thus causing another upleg in equities and more dollar suffering, to sounding hawkish and hitting back on expectations for a September move by highlighting the strength of the US economy and the recent stickiness in inflation, which will most likely cause a risk-off reaction in equities but boost the dollar.

Oil’s downward move continues

WTI oil futures continue their downward move, currently hovering a tad above the 2024 low of $72.10. China’s continued economic weakness, which dents its demand for oil as seen in the latest report for a small reduction of Saudi Arabia’s oil exports to China, fears for a US recession and, more importantly, the OPEC+ alliance’s difficulty in maintaining its voluntary production cuts and thus exaggerating the demand-supply mismatch, are fueling the current bearish trend.

China’s continued economic weakness, fears for a US recession and the OPEC+ alliance’s difficulty in maintaining its voluntary production cuts are fueling the current bearish trend

Geopolitics appear to have a low impact on oil prices at this stage as the market seems convinced that Iran’s response to the recent assassination of Hamas’ political leader will not affect the oil trading routes. Interestingly, a likely ceasefire between Hamas and Israel should alleviate any lingering concerns about an escalation of the conflict, almost totally removing one of the main reasons that could cause an oil price rally at this stage.

Source by: XM Global