- Gold pulls below record high; might give up more ground

- Market trend stays positive as long as price holds above 2,463

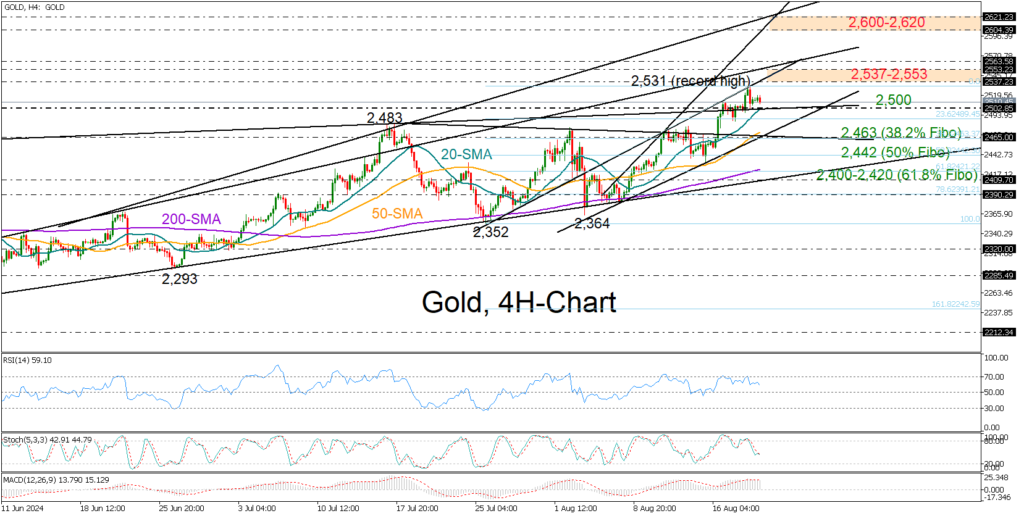

Gold lost momentum after unlocking an all-time high of 2,531 on Tuesday near the rising constraining line drawn from July’s low, but it maintained its resilience above the 2,500 psychological number by the end of the day.

The technical picture in the four-hour chart has started to show some cracks. The precious metal appears to have formed a bearish engulfing candlestick pattern at the peak of its upward movement, indicating a potential downward shift in the price. The indicators are beginning to trend downward, further validating the negative scenario.

Nevertheless, the price is still in a bullish channel, so any possible drop can be seen as part of the upward pattern unless the bears break below 2,463. Meanwhile, the market could find support from the 20-period simple moving average at 2,500 and the 23.6% Fibonacci retracement of the July-August rally at 2,489.

The 50% Fibonacci level of 2,442 could ease selling forces below the channel ahead of the 61.8% Fibonacci level of 2,420, while a step below the ascending trendline at 2,400, which has been buffering downside movements since the end of June, could send stronger bearish signals if breached.

If the bulls stay active, their goal will be to pierce through the border between 2,537 and 2,555, with potential to continue towards the next barrier at 2,600-2,620. Slightly higher, the 2,650 region could be another hurdle.

In short, gold could become more susceptible to downward risks in the upcoming sessions. However, the market sentiment would only be dampened if the price falls below 2,463, whilst a rebound above 2,537-2,555 could increase buying interest.

Source by: XM Global